The combination of two Japanese utilities to form the world's biggest liquefied natural gas importer will give Asian buyers greater muscle to press producers for more flexible contracts and potentially deepen a new era of weaker prices.

Tokyo Electric Power Co (Tepco) and Chubu Electric Power Co plan a joint venture from April that would gradually include fuel procurement, investment in gas assets and a potential union of their fossil fuel power plants.

Together they will account for about 16 percent of global LNG purchases, overtaking leader South Korean utility Kogas, helping them push for increased contract flexibility as Japan seeks to revamp the way LNG is sold after years of soaring costs.

More chances to renegotiate prices and diversified pricing contracts could ultimately lead to even lower prices, currently close to five-year lows, and cut profitability for big suppliers in Australia and elsewhere.

"In the longer term, Japan wants to restructure gas pricing, especially in the wake of the Fukushima disaster, and this move goes some way to achieving that," said Tom O'Sullivan, founder of independent energy consultant Mathyos Japan.

The merger comes as the global LNG market, led by developments in Asia, has gone from undersupplied to glut within less than a year, flipping the relationship between buyers and sellers. Producers who previously dictated terms and pricing have been forced to offer discounts and looser terms for their cargoes.

Asian spot LNG prices, buoyed in recent years by soaring demand from emerging markets like China and India, have come off by two thirds since February 2014 as Asia's economies slow and new production comes online in the region.

The United States also plans to start LNG exports within a year, while oil prices - used as a price benchmark for many LNG sales - have nearly halved since mid-2014.

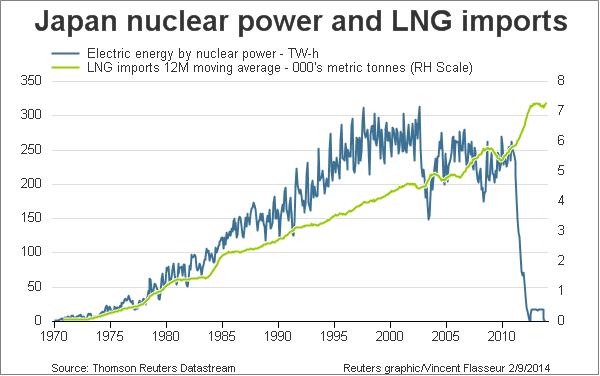

The change will mean billions in savings for Japan, which takes about a third of global LNG supplies and has been spending roughly $28 billion extra a year since shutting its nuclear plants in the wake of the 2011 tsunami and Fukushima nuclear disaster, pushing it into record trade deficits.

METI BACKS MERGER

The Chubu-Tepco tie-up will help Japan reshape LNG buying in line with a push by Japan's powerful Ministry of Economy, Trade and Industry (METI), which has backed the merger.

"The discussions have gone very well ... we will have a big (LNG) purchaser" by around September, Ryo Minami, director, Oil and Gas division of the Ministry of Economy, Trade and Industry's Agency for Natural Resource and Energy, told Reuters.

The new alliance is expected to push for more flexible pricing, potentially changing clauses that ensure gas must only go to a named destination, which effectively rules out trading.

It could also bargain harder for more price reopeners, clauses that allow the price to be renegotiated in the wake of price movements, said Michael Jones, a senior analyst at energy researcher Wood Mackenzie.

"We will negotiate with the (LNG) sellers, taking advantage of big-volume purchases," said Yukio Kani, vice-president of Tepco's fuel and power company.

Japanese buyers were also likely to be more aggessive in taking equity stakes in LNG projects and would look to diversify supply by pricing their LNG against U.S. gas and other indices, rather than just oil, said WoodMac's Jones.

"Rather (than) focusing on fierce competition at home, it's more about companies trying to cooperate in order to reduce cost and increase flexibility on the procurement side," he said.

The tie-up could also prove a benefit for South Korea's Kogas, which is set to be displaced as the world's No.1 LNG importer.

Analysts say that with two such big importers in northern Asia, who share similar seasonal and industrial import patterns, their pricing power may increase further.

"Kogas could see some positive knock-on benefits in terms of having another large buyer in their neighbourhood, as they will inevitably be negotiating for similar terms and can speak with a louder more unified voice... so they can negotiate better terms," said Jones.

Source: Reuters

IT

IT  en

en