Although the coronavirus pandemic has negatively impacted the long-term prospects for the global LNG industry and the forecasts for the commissioning of LNG production capacities around the world have been revised downwards, Russian operators predict that the demand for LNG will continue to grow, including as a fuel for transport.

With the tightening of international maritime environmental laws, LNG is indeed becoming an increasingly popular marine fuel. One of the regulatory instruments put in place to intervene on this new market was the liberalization of LNG exports. Independent gas producers are free to export LNG in large and small volumes.

To gain share in the Pacific Basin marine bunkering market, Gazprom plans to build an LNG plant on the Lomonosov Peninsula (Perevoznaya Bay) near the port of Vladivostok in the Russian Far East.

In cooperation with Russian machine building firms, Gazprom is also actively participating in projects to expand the use of LNG in road, rail and river transport, such as shunting and mainline locomotives and a passenger motor ship for river cruising (built in Tatarstan in 2020).

KAMAZ LNG-powered special purpose trucks transport thermally insulated containers with liquid helium from the Amur gas processing plant to ports based in the Primorye Territory. Furthermore, the development of the small-scale LNG segment is considered essential to extend the gas infrastructure and supply gas to Russian consumers who are far from the gas distribution lines.

For example, a small-scale LNG complex in the Perm Territory has supplied gas to more than 2,000 households and 10 boilers since 2015. Two more investment projects involving natural gas liquefaction technologies will be delivered between 2021 and 2025. in Tomsk and Sakhalin Regions.

Novatek has started LNG exports from its new small-scale LNG plant at Cryogas-Vysotsk in the Leningrad (Baltic Sea) region. The first cargoes shipped from the port of Vysotsk were delivered directly to end users in Lithuania, Finland and Sweden in the first half of 2019. The project serves the Baltic and Northern European markets, the Russian domestic market and marine fuels of the Baltic market area.

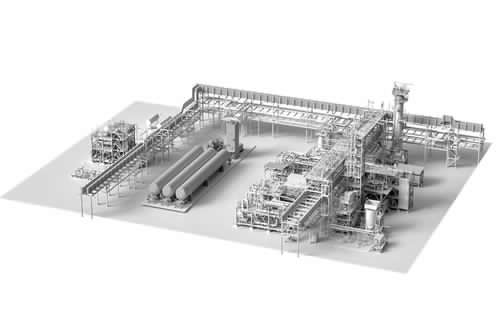

In competition with Novatek, Gazprom is developing a small-scale LNG project consisting of a liquefaction plant, storage facilities and shipping capacity at the Portovaya compressor station with a capacity of 1.5 Mtpy of LNG. The project was conceived in the expectation that LNG demand for marine bunkering will continue to increase in the Atlantic basin market.

To expand its presence in the European natural gas vehicle (NGV) market, Gazprom has built small-scale LNG plants near the western border in Kaliningrad, Kingisepp, Pskov and Petergov. From these plants, LNG export volumes are delivered by truck to off-grid consumers in Poland, Lithuania, Latvia and Finland.

In its effort to encourage the switch from diesel to LNG as a vehicle fuel, Novatek has completed a pilot project in the Chelyabinsk region to promote the use of LNG as a fuel for heavy mining trucks. The change in fuel use would result in potential savings in operating costs, increased mileage per tank of LNG and reduced maintenance costs.

In 2019, Gazprom Export exported 443.5 tonnes of small scale LNG, more than 9 times more than in 2018. Most of this growth came from the shipping of ssLNG from the Vysotsk LNG plant, the first project of Medium-scale LNG on the Baltic Sea. From March to December 2019, a total of 381.5 tons of SSLNG were loaded. The same year, the Company carried out the first ever shipment of LNG from Russia to Mongolia by rail with isocontainer.

Source: Gazprom - Gasprocessingnews

EN

EN  it

it