In the online meeting promoted by the University of Cagliari with the organizational support of the ConferenzaGNL last June 3, dedicated to the development of LNG as a fuel especially for maritime use but also for the methanisation of Sardinia, Corsica and evaluations on the Island of Elba, professor Giovanni Satta of the University of Cagliari has updated the data on the size of the fleet of LNG ships by 2027.

The university research activity, which took place within the European Interreg Italy - France Maritime Program, and which involved the Universities of Cagliari, Genoa and Pisa on the Italian side, also included a series of meetings with operators of the sector, to directly collect their points of view and the strategic perspectives of the new industrial chain of the small scale LNG.

In this context, the University of Genoa has developed a statistical system that is automatically updated each time a new LNG ship order is entered, accompanied by the main technical and market data (use, tonnage, flag, ownership, refueling …), Also taking into account those already active and those under construction.

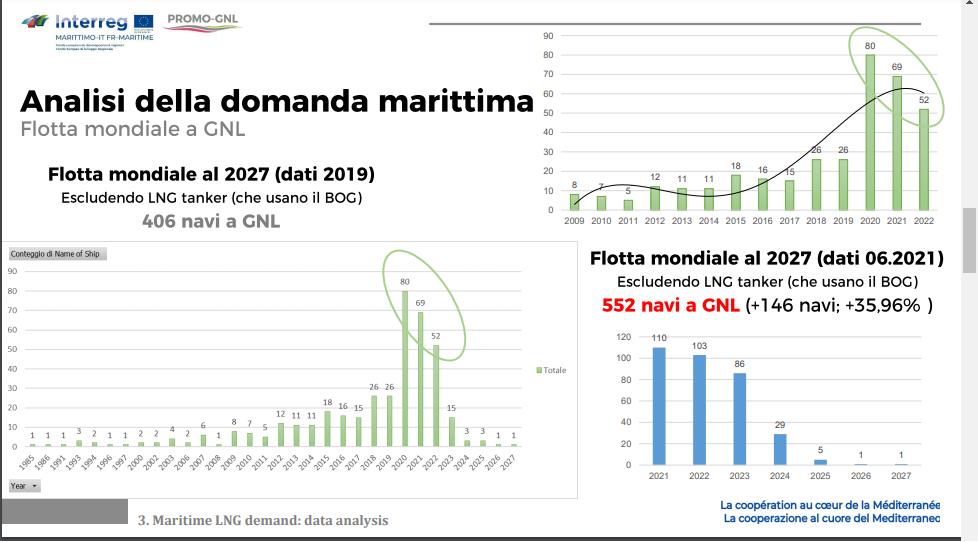

The system update in June 2021 shows a real boom in orders for LNG ships, with the exclusion from the calculation of large LNG tankers destined for regasification plants. The latter, which have been in use for 60 years now, use boil off gas, the gaseous methane that forms during the voyage, as fuel.

Compared to the data at the end of 2019, taking into account the slowdown due to covid in 2020, the census currently shows a 35.96% increase in the world LNG fleet which will be operational in 2027. These are 552 ships of which the launch, compared to the 406 expected at the end of 2019. Plus 146, all of large tonnage, plus the small scale LNG tankers for supplying coastal depots and ships (ship to ship; ferries are instead usually supplied from the pier with four tankers at a time).

There are 110 new ships arriving by 2021, 103 in 2022, 86 in 2023, 29 by 2024, 5 by 2025 and one in 2026 and 2027. 195 were LNG ships operational in 2020, 238 are now. The data is constantly updated because there is no week without some new order, which naturally moves forward in time. On June 14, for example, the Japanese shipowner NYK Line ordered 12 new LNG-powered car transport ships, with delivery by 2028, yet to be included in the statistical system.

Other interesting data concern the type of ships: container ships 15% in 2020, 18% today, 28% in 2027; cruises 1% in 2020, 2% today, 5% in 2027 (27 ships); similar growth for “dry bulk”, 2% in 2020, 3% today, 5% in 2027; the largest share is for the “other tankers”, 21% in 2020, 23% today, 33% in 2027; only the passenger and Ro Ro sectors decreased in percentage terms, 33% in 2020, 25% today, 15% in 2027.

With 67% overall, Norway, Germany, France, Sweden and the Netherlands are the leading countries in the availability of LNG ships by 2027, with the historic record of Norway which, however, decreases proportionally as new orders arrive. Italy trailing behind with 2%.

EN

EN  it

it